The Fall market in Manhattan has been turning out as we expected. As interest rates have continued to climb, contract activity has continued to decline. Prices have still not followed suit, however, and inventory levels continue to drop as many sellers elect to delay listing until until Spring or Fall 2023 in hopes of riding out the high-rate environment. More specifically, contract activity was down more than 40% last month year-over-year; however, looking past 2021 and 2020 (both outlier years), contract activity is only 12% lower than in October 2019 and 20% lower than the October average for the years 2008-2021. Supply has remained relatively stable, despite this decline in contract activity, as there have been 20% fewer new listings this October compared to 2021 and 7% fewer than in October 2019. |

While it's impossible to say for sure, most of the NYC real estate community is anticipating a quiet end to 2022, with the current trends continuing. While overall prices have not budged much so far, price reductions continue to come in and we suspect negotiability is up, particularly in some sectors. We expect to see the results of this in sale metrics for the first quarter of 2023, when deals currently being negotiated close. Anecdotally, while our team has had fewer listings this Fall, those we had entered contract relatively early this season and at good prices. Well-priced properties that have value are still trading despite the interest rate environment and we have seen more cash buyers than expected, especially for the coop market. |

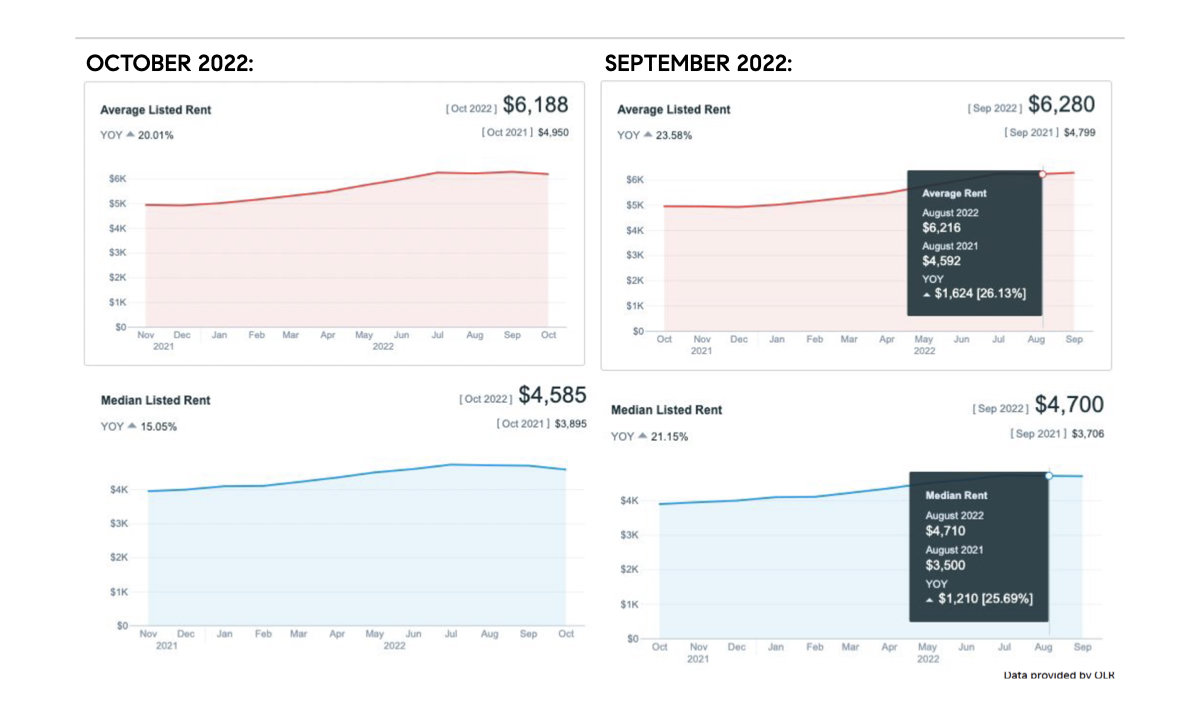

The NYC rental market continued to cool slightly last month, with the Manhattan median rent price down slightly from $4,700 in September to $4,585 in October. However, inventory remains extremely tight, and October's median price is still 25% higher year-over-year -- and even more dramatically elevated compared to pre-pandemic rents. A Forbes article this month indicates investor demand for NYC multi-family properties remains high, as they offer an attractive alternative to hedge against inflation and market volatility in the near future. |

In Brooklyn, inventory shrunk even further with both new listings and total supply down by double digit percentages year-over-year in October. This kept days on market and median price metrics even with last year, despite substantial drops in contract and sales activity. The fervor of bidding wars has cooled, though the imbalance in supply and demand -- particularly for townhouses in prime areas -- has kept prices high. We have seen several instances where sellers are making deals pre-market rather than listing with the expectation of a massive bidding war as they would have done 6 months ago. |

Stocks dropped after the Federal Reserve again sharply raised interest rates on November 2, and while the Fed did hint at a possible slowdown in the pace of increases indicated it still has work to do in its fight against inflation. |

Sharply higher mortgage rates caused mortgage demand to drop to the lowest level since 1997. Mortgage rates fell slightly to start this week, but are still well over 7% after starting the year at around 3%. |

Forbes Investment Sales & Capital Services Groups indicate free market apartment buildings in NYC will remain an attractive long-term inflation hedge for investors due to the long-term supply constraint for apartments in New York City (a projected deficit of 560,000 units by 2030) and rent growth. |

In the face of skyrocketing rents, some NYS l awmakers on the left who have traditionally been fierce critics of the real estate industry are shifting to embrace new housing development, even if it’s not fully affordable. |

There are pros and cons of owning a "Penthouse" apartment in NYC, but one big pro is resale. On average, penthouses tend to sell for about 5 to 10 percent more than non-penthouse apartments and tend to be less affected by market volatility. (BRICK UNDERGROUND) |

Looking for more? Connect with us for real estate news and market insights. |

With all the noise about the housing market nationally and locally, it is important to note that real estate -- especially in NYC -- is hyper local. Every neighborhood, block, even building, is impacted differently by macroeconomic conditions, and the market can differ wildly for specific price points or property types. While we hope you find these reports helpful in discerning trends in NYC, they may not reflect how your property might perform or what to expect from your home search. If you have questions, we are always here to provide a consultation.

|

Make sure to take a peek at our current and upcoming listings below. We’ll be back next month with more real estate news. Until next time! |

|

© Compass 2022 ¦ All Rights Reserved by Compass ¦ Made in NYC

Compass is a licensed real estate broker. All material is intended for informational

purposes only and is compiled from sources deemed reliable but is subject to

errors, omissions, changes in price, condition, sale, or withdrawal without

notice. No statement is made as to the accuracy of any description or measurements

(including square footage). This is not intended to solicit property already listed.

No financial or legal advice provided. Equal Housing Opportunity.

All Coming Soon listings in NYC are simultaneously syndicated to the REBNY RLS.

Photos may be virtually staged or digitally enhanced and may not reflect

actual property conditions.

marketingcenter-newyorkcity-manhattan

|

|

|