|

|

T h e S u b u b a n R e a l E s t a t e N e w s M A R C H 2 0 2 2 |

|

|

Welcome to the M a r c h 2 0 2 2 edition of the Suburban Real Estate News. When I think of this past month 2 things jump out at me. The pace of the market and interest rates are finally on the rise. The speed at which deals are closing is at rate I have never seen. Most homes are going live to contract status within a week. This is giving agents very little time to do their due diligence to be able to check municipals. The landscape is so competitive that buyers are doing anything to win the bid; waiving inspections, paying cash, removing financing contingencies, closing late, closing early and giving shutdown offer prices hundreds over ask. The rates are climbing quicker than expected and buyers are now able to afford less. This will have a trickle-down effect on pricing, but for this month we have not felt that slow down just yet. People have More Money Money is coming from every direction, not just the financial sector. In the past Wall Street led the charge for high end purchases, now you have all sorts of different people with tech & crypto making a significant impact. Household net worth rose 14.4% in 2021, measured from year-end 2020 to year-end 2021, more than double the average net worth growth rate of 6.2% from 2015 - 2019. Owners’ equity in real estate as a percentage of household real estate owned was 69.3% at year-end 2021, its highest level since early 1987. Inflation is Everywhere From gas to couches and everything in between we are all paying considerably more for goods and services. Consumers will pay more and more until they don't, especially when they see they are being price-gouged under the rise of high inflation. UK Central Banker Charles Goodhart thinks a seismic shift is underway in the world economy, one that fiscal stimulus and the post-pandemic recovery will only hasten. A long glut of inexpensive labor that had kept prices and wages down for decades is giving way to an era of worker shortages, and hence higher prices. Massive global income disparities if sustained could force labor costs even higher and inflation. He predicted that inflation in advanced economies will settle at 3% to 4% around the end of 2022 and remain at that level for decades, compared with about 1.5% in the decade before the pandemic. So, it is good to own real estate, or have a fixed-rate mortgage. Rates Matter Bloomberg Reports; The combination of surging home prices and jumping rates on 30-year mortgages means that home buyers now face a much higher monthly payment. Compared to the end of 2021, the average sized loan at the 30-year effective mortgage rate will now set one back $2,380 a month, before home owners insurance and property taxes, according to data from the Mortgage Bankers Association. The average sized loan at the end of 2021 was $401,600 and the 30-year mortgage 3.47% this would have cost $1,797 a month, according to the Bloomberg mortgage payment calculator. The loan originated today will cost about $7,000 more per year. Setting a soft tone for the usually busy spring season, pending home sales, which measure signed contracts on existing homes, fell 4.1% in February compared with January, the 4th straight month of declines in pending sales, which are an indicator of future closings, one to two months out. The median monthly payment on a new mortgage is now taking up a much larger share of a typical consumer’s income. It jumped 8.3% in February compared with January. The average rate on the 30-year fixed mortgage shot significantly higher, rising 24 basis points to 4.95%. The quicker-than-expected rise in rates has weighed on demand for mortgages and now comes the question: are incomes that much higher to sustain this? Much of our current home inflation is being fueled by new audiences for a lower supply. And with housing representing a big chunk of inflation figures will this persist for awhile or are signs of a housing bubble on the horizon? |

|

|

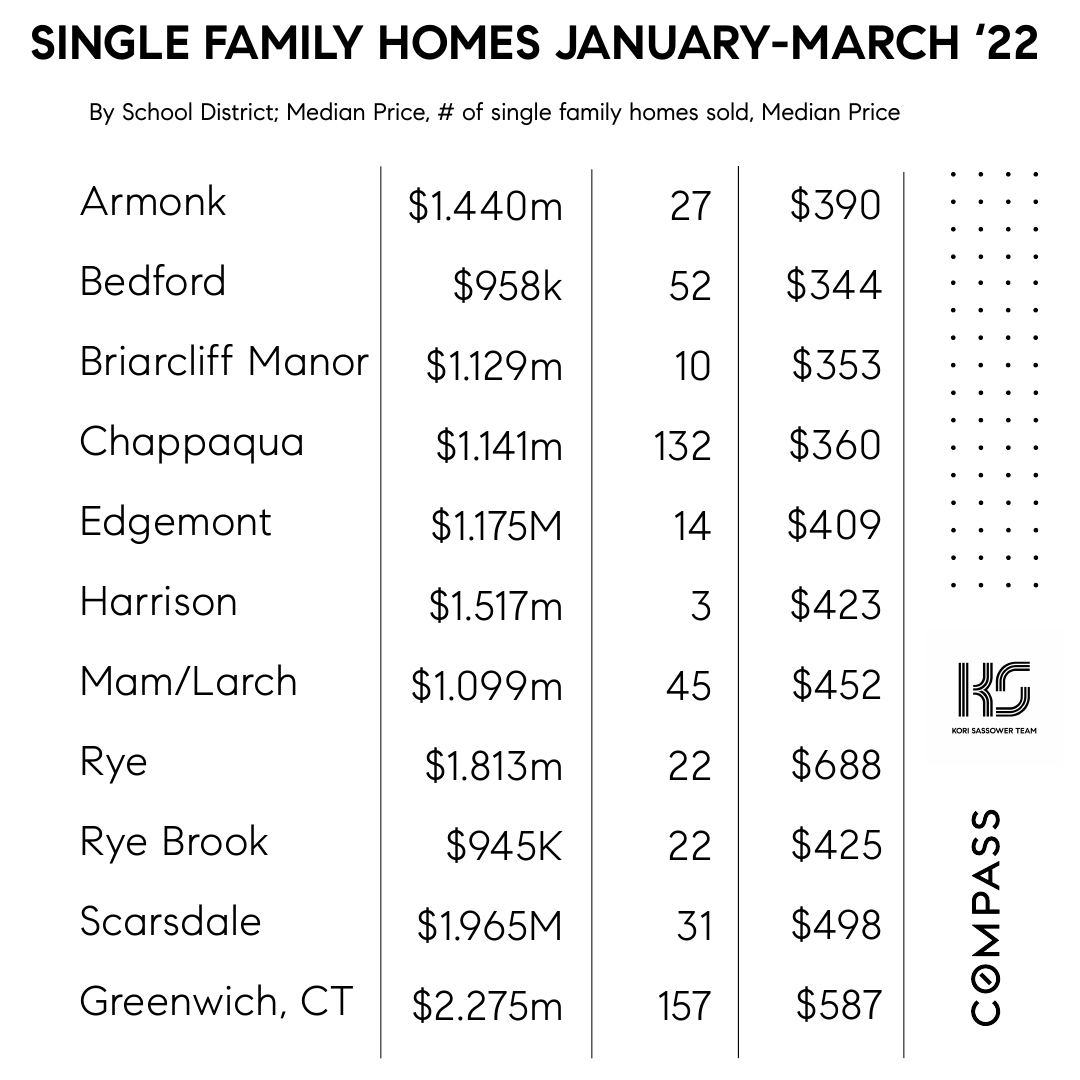

This chart shows us a few things; which towns have the most and least inventory, which towns are the most/least expensive per square foot and which towns have the highest/lowest priced homes (not necessarily the most expensive but the median price is higher/lower). This chart should help guide you. For example; if you are a $900k buyer and not finding anything to buy in Harrison maybe that is because the median price is $1.5m and there is very little inventory in that price range. As always, please feel free to reach out with any questions. |

|

Town Compare What's on the market for $1.2m? |

|

|

Town Compare What's on the market for $2.0m? |

|

|

Move Fast and have a great month! |

|

|

|

|

|