|

|

S u b u r b a n N e w s S e p t e m b e r 2 0 2 2 |

|

|

Welcome to the September 2022 edition of the Suburban News. Housing is an important indicator of economic activity for several reasons: it bears a direct relationship to the consumer’s ability and willingness to borrow and spend. A slowdown in housing at this point doesn’t necessarily mean a big wave of mortgage delinquencies or foreclosures are coming, but it does indicate consumers are likely exiting the market. That could be due to decreased affordability (increasing mortgage rates amid rising home prices), or because consumers are worried about their economic prospects in the near-to-medium term or both. Either way, it’s not exactly a signal of increasing growth and prosperity. A slowdown in this sector typically results in a ripple effect across other sectors such as construction, building materials, and retailers closely tied to home improvement, furniture, or home electronics. If fewer homes are being built, fewer workers are needed to build them, which influences unemployment. Rates are still climbing... The rates are still climbing. FED Chief Jerome Powell said higher interest rates likely will persist for some time. The historical record cautions strongly against prematurely loosening policy. The remarks come amid signs that inflation may have peaked but is not showing any marked signs of decline. Powell said the Fed will not be swayed by a month or two of data. Lots of the data they look at is delayed. The duration of US recessions has lasted anywhere between 2 months and 18 months in the past 50 years. Price Dropping or scaling back of excess Pricing? Across the US, 21% of home sellers dropped their asking prices in July, the highest share since tracking in 2012. Let's also not forget some of these asking prices had assumed 5-20% escalations over the last selling price in the area much of this is simply the scaling back of excess pricing ambition/exuberance. The Rental Price Surge Rental prices are soaring by double digits. As higher borrowing costs force some to continue renting or opt to rent instead of buy, the pricing pressures on the rental markets keep growing. Unlike a fixed mortgage, rising rents directly impacts monthly consumer costs. As rents rise, the appeal to investors to buy homes to rent keeps growing as returns rise and pose an investment with solid returns. Rising rents should probably be the most important motivator for people to buy and own a home. Waiting could become very expensive over time. An average rental of $6,500 a month costs $78k per year. A million-dollar home that increases 10% in price is an additional $100k - if you wait - with a much higher rent cost - that cost should be weighed up against the potential savings of a market dip. Water Run-Off – New Home Amenity? Roughly 90 million Americans are living under drought conditions. Water scarcity is emerging as a threat that could heighten business disruptions, crimp profits, and jeopardize growth—especially in thirsty industries such as agriculture, fashion, computer-chip making, and data centers. Expect water efficiency for homes to become a growing industry. With fewer, more extreme rain events in areas, capturing run-off could become a new home 'amenity': roofs account for a large surface area, and when it rains, this water is typically routed through a system of gutters and pipes and dumped unceremoniously into your yard, where it washes away valuable topsoil. Roof catchment systems, the most common type for residential applications, collect this water by routing it through a system of gutters and pipes into a rain barrel, usually located on the ground level. More Warehouse Space – Less Office Space Major U.S. and Canadian pension funds are cutting back investments in office buildings, betting that prices will likely fall as the 5-day office workweek becomes a thing of the past. The 3-day office work week seems to be a growing trend. Retirement funds are still buying property, sometimes to hedge inflation. But those investments are more focused on warehouses, lab space, housing and infrastructure such as airports. Did you Know? The head of the world’s largest building materials company CRH has warned that the industry faces a “second wave” of inflation as spiraling energy prices drive up the cost of everything from wages to logistics. Now, here is what is happening in the local Rye Brook Real Estate Market: |

|

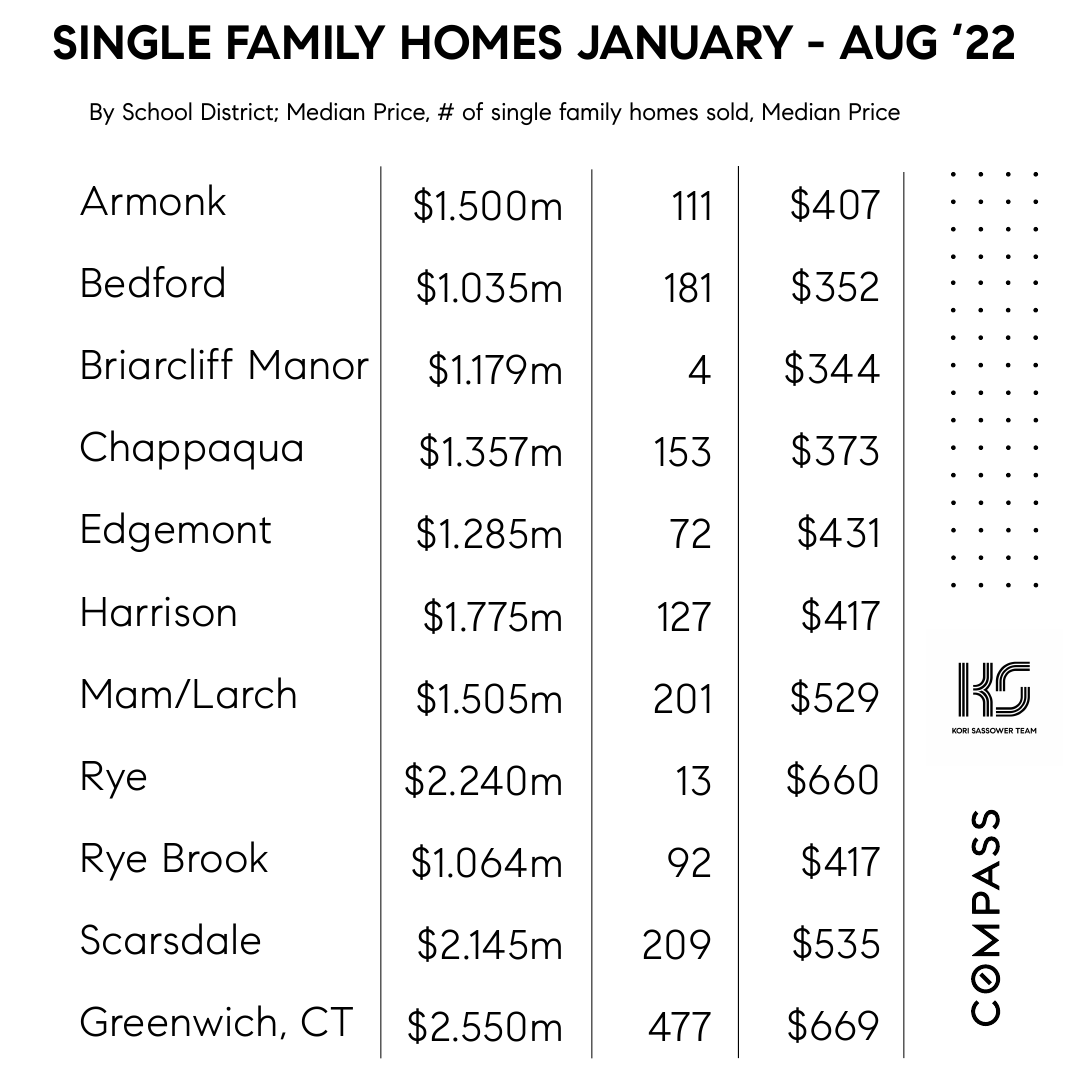

Year to Date Stats on the Towns |

|

|

What's on the Market in Westchester for $1.4m? |

|

|

MY ACTIVE LISTINGS |

|

|

|

|

|

|