|

THE MICHAEL GRAVES TEAM AT COMPASS |

|

From the Desk of Justin Rubinstein |

|

There’s a Savvy Way to Defer Capital Gains Real Estate Tax. It’s Called a 1031 Exchange.

|

|

Hang around real estate investors long enough, and you’ll eventually catch wind of a comment: “I’ve just 1031’d my property. Sounds kinda cool. But what’s it all about? A 1031 Exchange is a swap of one investment property for another, which allows capital gains taxes to be deferred. To qualify, most exchanges must be of “like-kind”—an enigmatic phrase that doesn’t mean what you might think. You can exchange an apartment building for undeveloped land, or a ranch for a strip mall. The rules are surprisingly liberal. There’s no limit on how frequently you can do a 1031. You can roll over the gain from one piece of investment real estate to another…and another…and build wealth by deferring taxes. Although you may have a profit on each swap, you avoid paying tax until you sell for cash many years later. Then, if it works out as planned, you’ll pay only one long-term capital gains tax. A few important details. The majority of exchanges are considered delayed, three-party scenarios. In a delayed exchange, you need a qualified intermediary professional who holds the cash after you “sell” your property and uses it to “buy” the replacement property for you. This three-party exchange is treated as a swap. You can’t receive the cash, or it will negate the 1031 benefits. Timing rules in a delayed 1031 Exchange: 45-Day Rule - Within 45 days of the sale of your property, you must designate the replacement property in writing to the intermediary, specifying the property that you want to acquire. The IRS allows you to designate three properties as long as you eventually close on one of them. You can even designate more than three if they fall within certain valuation tests. 180-Day Rule - You must close on the new property within 180 days of the sale of the old property. Reverse Exchange – This one’s tricky, but it’s even possible to buy the replacement property before selling the old one and still qualify for a 1031 Exchange. In this case, the same 45- and 180-day time windows apply. 1031s for vacation homes. Taxpayers who turn vacation homes into rental properties can fall under the 1031 Exchange “umbrella.” Example: You stop using your beach house, rent it out for six months or a year, and then exchange it for another property. If you get a tenant and conduct yourself in a businesslike way, then you’ve probably converted the house to an investment property, which should make your 1031 exchange perfectly appropriate. Can You Do a 1031 Exchange on a primary residence? A primary residence does not usually qualify for 1031 treatment because you live in that home and do not hold it for investment purposes. However, if you rented it out for a reasonable time period and refrained from living there, then the primary residence becomes an investment property, which might make it eligible. 1031s for estate planning. One of the downsides of 1031 exchanges is that the tax deferral will eventually end and you’ll be hit with a big bill. However, if you pass away – please, take your time! - without selling the property obtained through a 1031 Exchange, then your heirs won’t be responsible to pay the tax that you postponed paying. They’ll inherit the property at its current market-rate value. Real estate remains an excellent hedge against inflation. With International crises, pandemic resurgences, and the latest buzz from the Federal Reserve, it’s no surprise that the stock market is a roller coaster of ups & downs. Investing in real estate continues to be a solid defense against inflation, especially with the tax advantages of the 1031 Exchange. I’ve crammed a lot of information in this newsletter. It will be my pleasure to answer all of your questions about 1031s, and the finest real estate opportunities. |

|

|

|

My Newest Listings |

|

Coming Soon... |

|

|

|

New Development of the Month |

|

The Brooklyn Tower |

|

|

Compass Finds a Home on the Fortune 500 |

|

In less than 10 years the company has become the #1 residential real estate brokerage in the United States and one of the youngest companies ever to make the Fortune 500.. |

|

Focus on Design |

|

The City’s First Mass-Timber Condos Are Now for Sale |

|

...But the firefighters were simply curious: They couldn’t believe the structure was made entirely of wood. “It was just like an afternoon field trip,” Liftin says. |

|

My Recently Closed Deals |

|

520 West 23rd, Unit 5E Chelsea 1-Bedroom Status - In Contract Lower East Side Condo Loft Status - In Contract 545 West End Ave, Unit 12C Upper West Side 3-Bedroom Co-Op Status - In Contract Upper West Side 3-Bedroom Status - In Contract 60 East 9th Street, Unit 434 Greenwich Village Co-op Status - Closed |

|

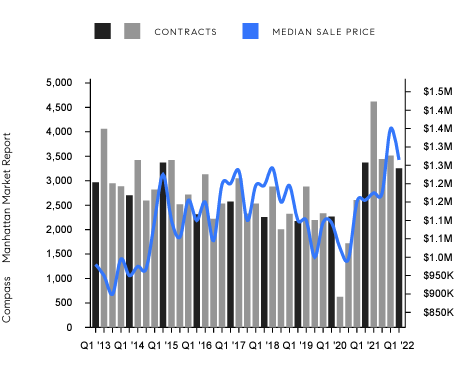

April 2022

Market Reports |

|

Justin Rubinstein is a 18-year veteran of the New York City real estate marketplace, who quickly gained attention from industry veterans and clients alike as a motivated and knowledgeable professional whose focus is on providing the best customer service possible while negotiating for and protecting his clients with dogged tenacity. This tenacity and hard work ethic has proven fruitful as he has successfully negotiated over $600M in real estate transactions to date. As a member of the record-breaking Michael Graves Team, Justin has enjoyed representing buyers and sellers of trophy properties such as the Time Warner Center, landmarked West Village townhouses, and new development penthouses. In each instance, his clients come away from the experience with a strong appreciation for his dedication and expertise... read more |

|