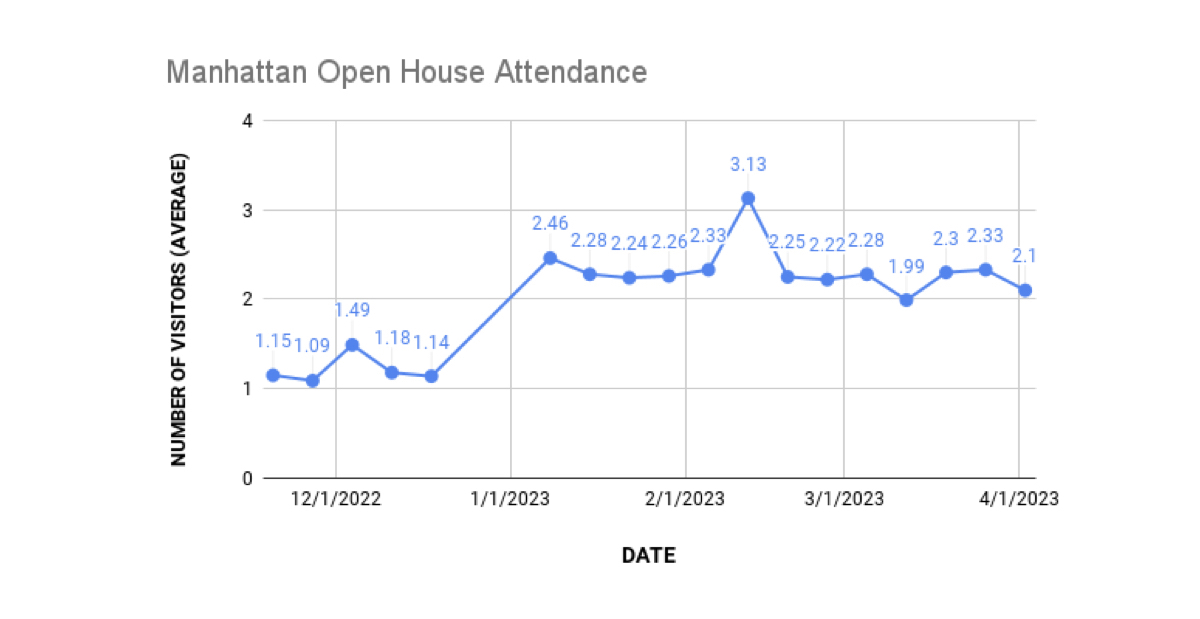

While the market seemed to be gaining momentum in early 2023 after a very slow second half of 2022, various economic factors (stock market fluctuations and distress at banks) dampened transaction activity starting in early March. As rising rates made borrowing more costly, many sellers refused to budge and buyers were left waiting for price drops that never came. Though sellers have finally begun to react to diminished buyer demand by lowering prices and increasing negotiability, until something really gives, this trend will likely continue through at least the first half of 2023. It is important to note that while many indicators appear weak, they are largely in line with pre-pandemic historical averages or weak-to-average years like 2018-2019, but other forces have kept prices relatively stable compared to those years. Market-wide there were 2,500 sales in Manhattan last quarter, a pace similar to what we saw in historically slower years such as 2018 and 2019. Much has been said about a drastic decline in sales year-over-year (-38%), but the significance of this figure is exaggerated in light of the fact that Q1 2022 had set a fourteen-year record high for first quarter sales. The total number of contracts signed last quarter was also significantly below last year (-37%), but was up compared to the end of 2022 and seemed to gain momentum until the bank collapses in early March. Transaction activity also paled compared to buyer interest -- open house traffic and inquiries have been up consistently last quarter compared to the end of 2022 -- which indicates that the market is hopefully poised for a recovery. |

Even with new listings lagging compared to last year, longer time to contract and fewer signed contracts caused Manhattan total supply to increase. However, current inventory is still 13% below historical first quarter averages, and the lowest for a first quarter since 2017. Inventory levels varied based on price-point and size: there were fewer lower-end, smaller apartments on the market as buyers gravitated toward these units, leaving more options on larger, over $1M apartments. |

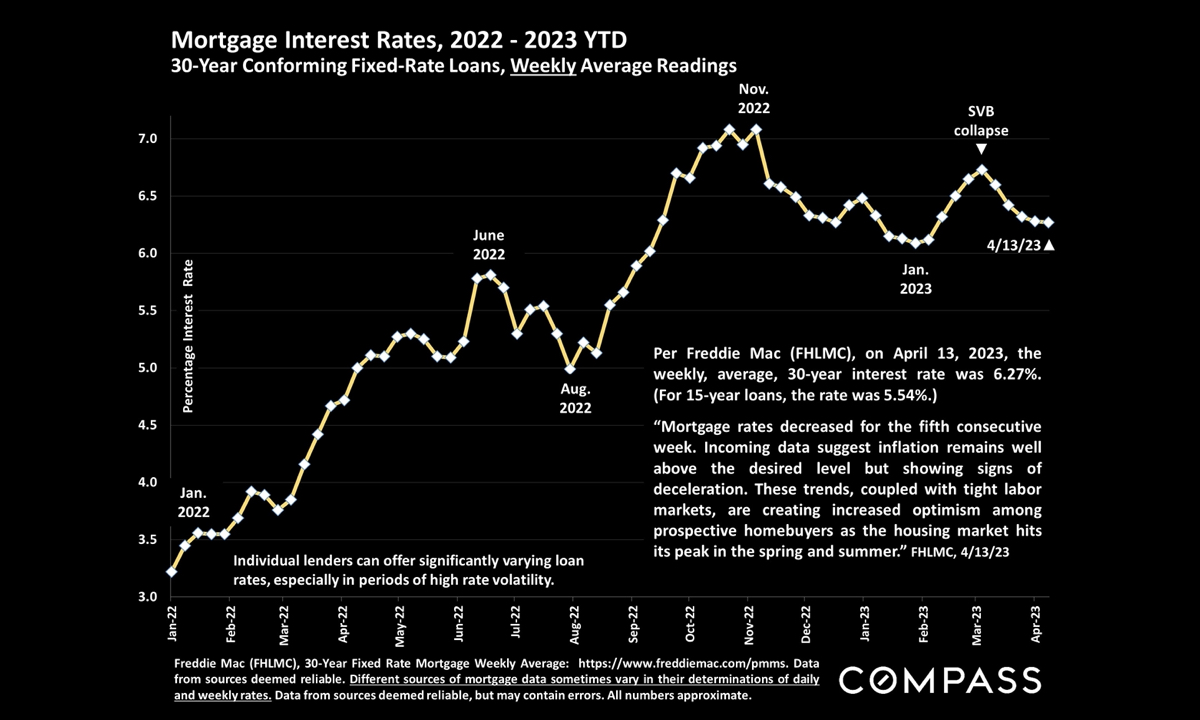

Prices declined for the second consecutive quarter with median price at its lowest point since Q2 2020 and average price at a two-year low. However, some of this could be attributed to an increased share of sales in the lower-end of the market (smaller homes and co-ops). While demand for these smaller, lower-priced home saw a marked decline during the immediate post-pandemic recovery as buyers sought larger spaces and took advantage of low mortgage rates to stretch their budgets, sales under $1M comprised 50% of Manhattan closings in the last quarter, their highest market share in three years. While it remains to be seen how the rest of the Spring market progresses in Manhattan, it is clear that consumer confidence and interest rates will both play a large factor. Mortgage rates have been volatile, but trending downward for 5 weeks since SVB collapsed, and ticked down again since the March inflation data came out earlier in the week. If inflation continues to come down we can expect rates to follow, and mortgage rates will eventually drop as well. |

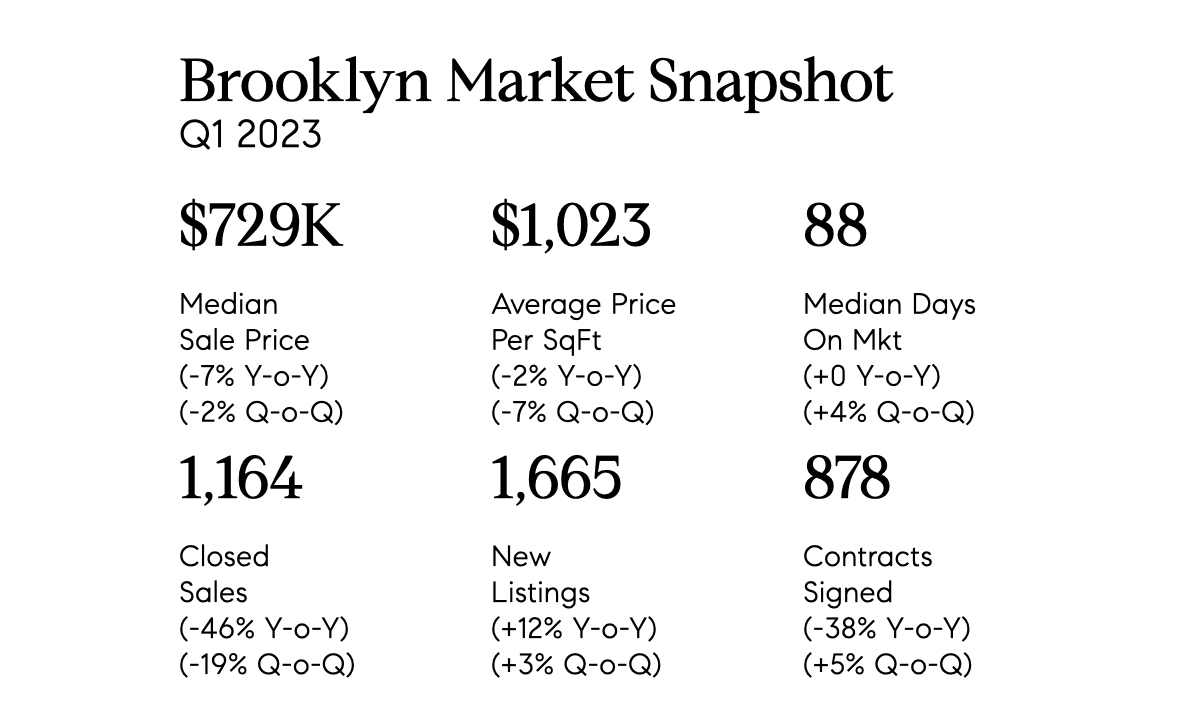

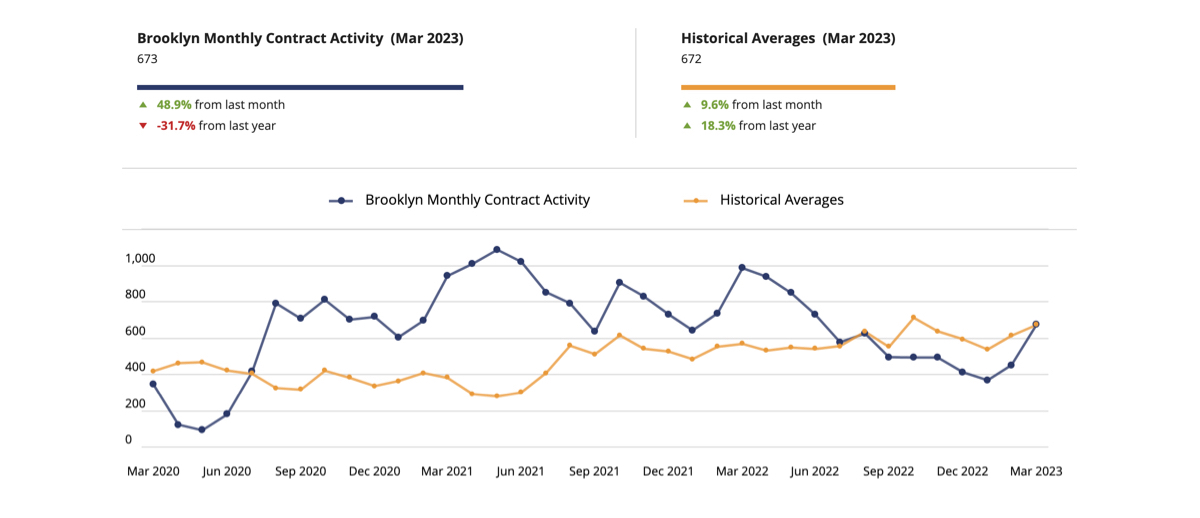

The Brooklyn market was affected by the same factors last quarter, albeit far less noticeably. Higher mortgage rates and overall economic concerns have cooled the market, but the borough continues to be teflon-tough in the most in-demand neighborhoods. Most notably, inventory was again down by double-digits (from already record-low figures). Fewer new developments hit the market and on the resale side, many sellers appear hesitant to list in a weaker economic climate and even more hesitant to let go of their low-interest mortgages to commit to a high interest rates when prices have not budged much in many neighborhoods. This is the sixth consecutive quarter of declining inventory, reaching the second lowest number of available listings since 2014 (excluding the pandemic “pause” in 2020). |

While both total sales and contracts signed were down compared to last year, which was an outlier, both figures were on par with pre-pandemic Q1 historical averages (2010-2020), indicating that despite massively constricted inventory, Brooklyn buyers are still pushing to get deals done. |

Brooklyn median price decreased 7% year-over-year last quarter making Q1 2023 the lowest median price we’ve seen in Brooklyn in the last ten quarters, but this reflects more of a shift in the types of sales rather than a drop in prices. The majority of sales were below $750K with buyers gravitating toward smaller homes, and resale condo and co-op median sale prices actually increased year-over-year; only new development fell. Looking at the various sub-markets, median sale prices increased last quarter in almost all of the most in-demand Brooklyn neighborhoods, including Williamsburg & Greenpoint, BoCoCa, Brooklyn Heights, DUMBO, Downtown, Fort Greene, Clinton Hill & Prospect Heights, with a meaningful decline in only in Park Slope & Gowanus (-17% Y-o-Y, due almost entirely to the fact there were essentially no new development closings there this quarter) and South Brooklyn (-13% Y-o-Y). Clearly the Brooklyn market remains strong in most areas, and while economic uncertainly and interest rates have put some buyers on the sidelines and "upgrades" on pause, there are still more buyers than homes in many areas, and we continue to see bidding wars on many properties. |

The average number of inquiries received by for-sale listings on StreetEasy was 9% above its pre-pandemic level in February indicating strong buyer interest, However, with affordability as a top concern, NYC buyers have shown patience in finding a home within their budget. |

Beginning in 2024, Local Law 97 requires that residential and commercial buildings of 25,000 SqFt +reduce greenhouse gas emissions and meet new energy efficiency goals, or face severe fines. Despite some available grants and rebates, updating the required infrastructure won’t come cheap. |

After a tumultuous few years, many hoped that the housing market would improve this spring. No such luck according to Jonathan Miller, a leading appraiser. “This is the year of disappointment... The sellers aren’t going to get their 2021 prices, and buyers aren’t going to get a substantial savings on the price." |

Mayor Adams outlined his plans to create more affordable housing, including controversial ideas to convert offices to apartments and a “modern-day, almost-SRO concept” of shared dormitory style living. |

Recovery is lagging for NYC's commercial real estate sector. According to New York Fed, “While the residential rental market has bounced back, the retail and office markets have remained slack - largely due to the shift to remote work and online shopping.” |

With all the noise about the housing market nationally and locally, it is important to note that real estate -- especially in NYC -- is hyper local. Every neighborhood, block, even building, is impacted differently by macroeconomic conditions, and the market can differ wildly for specific price points or property types. While we hope you find these reports helpful in discerning trends in NYC, they may not reflect how your property might perform or what to expect from your home search. If you have questions, we are always here to provide a consultation.

|

Make sure to take a peek at our current and upcoming listings below. We’ll be back next month with more real estate news. Until next time! |

|

© Compass 2023 ¦ All Rights Reserved by Compass ¦ Made in NYC

Compass is a licensed real estate broker. All material is intended for informational

purposes only and is compiled from sources deemed reliable but is subject to

errors, omissions, changes in price, condition, sale, or withdrawal without

notice. No statement is made as to the accuracy of any description or measurements

(including square footage). This is not intended to solicit property already listed.

No financial or legal advice provided. Equal Housing Opportunity.

All Coming Soon listings in NYC are simultaneously syndicated to the REBNY RLS.

Photos may be virtually staged or digitally enhanced and may not reflect

actual property conditions.

marketingcenter-newyorkcity-manhattan

|

|

|