|

|

|

|

Austin real estate news, analysis and other stuff! |

|

What's going on with the housing market? |

|

Now that the spring selling season is well underway, I can finally tell you about our post-pandemic and post-Fed-going-nuts-raising-interest-rates New Normal. I'm going to walk you through several charts that will give a snapshot into what our housing market has been through in the last five years and where we are now.

👇🏻👇🏻👇🏻👇🏻👇🏻 |

|

|

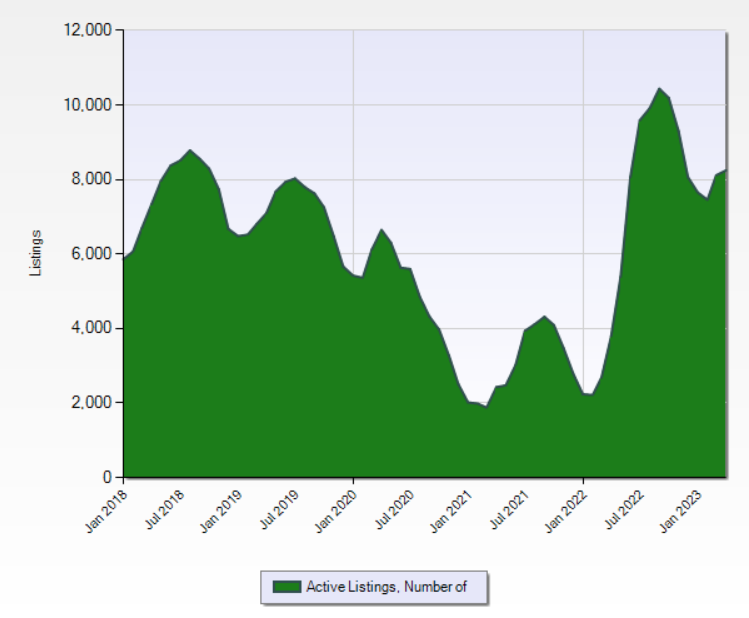

You will notice that we are in a period of relatively high inventory in Austin. Right now, we have 3.2 months of inventory in our market, which is still considered a seller's market -- but it's historically high for Austin. (Yet another reason to totally ignore all those national headlines about how we have an inventory problem in real estate. Not so much in Austin!) For buyers, this means you have CHOICES. More choices than you would have had at any time in the last five years. That's awesome. One of the biggest issues for both sellers and buyers in the recent past has been this persistent issue of low inventory. It makes people afraid to sell if they feel like buying will be difficult. Now let's take a look at what's going on the number of actual sales. This is different from inventory, it means the number of actual closed sales. 👇🏻👇🏻👇🏻👇🏻👇🏻 |

|

|

This chart is saying, "Hey, you have fewer sales than you normally do this time of year." Notice that in the previous five years, we had more sales in spring than we do this year. I also went back and looked at our sales history in 2009 and 2010 during the Great Recession and we had fewer sales then versus 2023. But this is not terribly meaningful to me because we have a lot more people and houses than we did back then. Because our housing inventory is relatively high, our lower closed transactions definitely points to a buyer confidence/interest rate issue. I know there are a lot of buyers sitting on the sidelines right now trying to wait out the 6-percent interest rates. The question is: How long are they going to wait this out? But when you look at price...things get interesting! 👇🏻👇🏻👇🏻👇🏻👇🏻 |

|

|

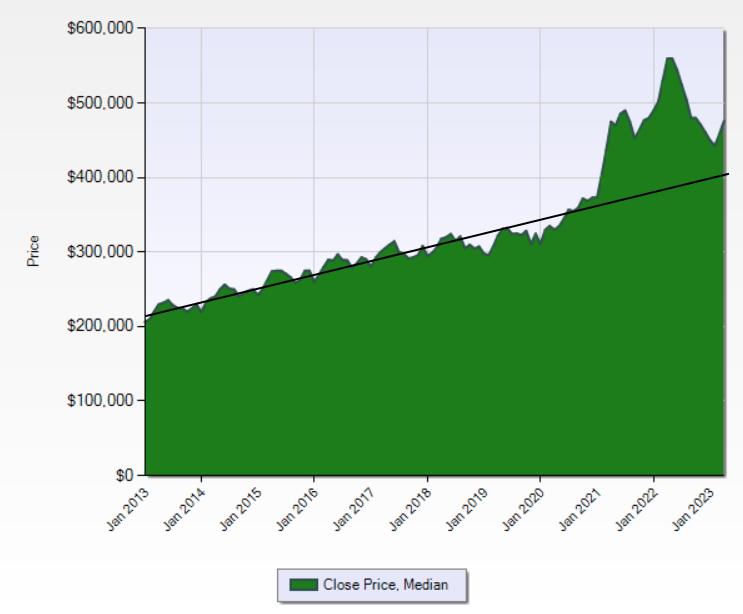

This is my favorite chart. Because it shows what an outlier those pandemic years were. We're simply inching our way back to the mean. Close readers of my newsletter will remember that the Austin housing market returns on average a little over 6 percent a year. Not bad compared to other cities. In fact, we are doing better than the mean! You can see that trend more clearly in the chart below of median closed prices over a 10-year period. This was probably my most surprising finding when reviewing the data for this spring. Our pandemic-era pricing has actually held up surprisingly well. 👇🏻👇🏻👇🏻👇🏻👇🏻 |

|

|

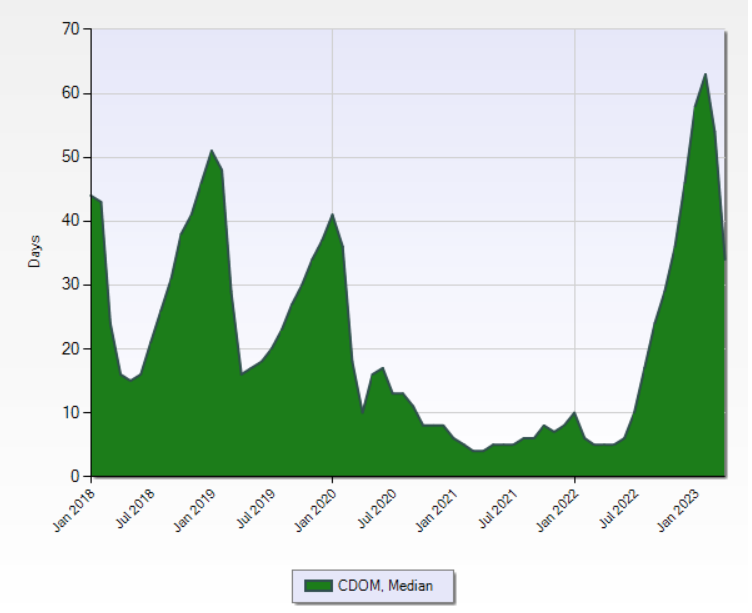

Another interesting statistic to check out is Days on Market. This is how long it took for a house to go under contract after it was first listed. This is a pretty good metric for how seller or buyer friendly a market is. Check it out! 👇🏻👇🏻👇🏻👇🏻👇🏻 |

|

|

The chart above is communicating a lot to me. It's saying that the pandemic years were an unusual time when homes flew off the market in a matter of days. It's also saying that homes sat on the market for a looooong time in Fall 2022, but that we've quickly bounced back to so-called "normal" Days on Market. FINAL THOUGHTS: The market is sending mixed signals, right? You would think with higher inventory and fewer sales that prices would be dropping. But that's not happening. Prices are not tanking and Days on Market are in the normal range. Why is that? I'm sure an economist would talk your ear off about Austin's strong job growth and rising interest rates and blah blah blah. But my pet theory for why we're seeing such contradictory data is that higher interest rates basically returned us to a slightly slower version of our pre-pandemic "normal" housing market. What that means is we have Two Markets -- there's the Good Houses and the Bad Houses. The Good Houses are selling in multiple offers. These are the ones that are staged well, are in good condition and are priced well. Even with higher interest rates, buyers can smell a good house and will pounce on it. The Bad Houses are riddled with problems that are scaring buyers. It's a bad location, a dirty house, high HOA dues, a small floorplan or crazy layout. Or, particularly in our suburban areas, there's a lot of competition from new construction putting pressure on price for any nearby resale homes. When you have choices as a buyer, why would you go for a Bad House unless it was priced as the deal of the century? The Good Houses are the reason our prices aren't tanking. The Bad Houses are why we have higher inventory and fewer sales. And for whatever reason, there's a lot of Bad Houses for sale right now. One final note from your favorite Realtor....Even though I am a data nerd at heart, I always have mixed feelings about sharing market statistics. It's because I preach that you should NOT try to time the market when it comes to buying and selling decisions, and part of that is not obsessing over housing market trends every month. But...I also know this is everyone's favorite topic! We are a nation obsessed with the question: How is the market doing? Just keep in mind it's just like your retirement account. Worth understanding and generally knowing what's going on, but don't make major decisions based on what the market is doing. Buy and sell when it makes sense for your life. The End. |

|

Five Things To Read |

|

1. Inside the Barbie Dream House I loved how Architectural Digest did an entire interview with the director of the new Barbie movie, and the set designer, all about how they created the life-size Barbie Dream House for the movie. The best detail in the whole story is how there was a nationwide shortage of that specific shade of pink because they were using so much of it to create the Barbie houses. Also, the ceilings are really short and there really is a slide that goes into the pool! I hope the movie producers know what a gold mine they have and they keep the Barbie Dream House set and sell tour tickets to tourists. |

|

2. The hottest house amenity these days is a cold plunge. Wellness is a big trend in housing lately, and we're starting to see a lot more saunas and cold plunges added to homes. The WSJ recently spotlighted a man in Austin who added a cold plunge to his backyard, and there are luxury developments in Austin also adding cold plunges to their amenities. Read more in the WSJ. |

|

3. Big Short investor warns about housing flood risk. Dave Burt, an investor who was featured in the book and movie The Big Short, is sounding the alarm about the next hidden threat to the housing market; flood risk. He believes lenders are overestimating the value of homes in flood-prone areas and it will only get worse with climate change. Read more in Inman. |

|

4. A quarter of homeowners are considered "house poor." A study of incomes versus housing costs reveals that 1 in 4 Americans is considered house poor, meaning they spend more than 30 percent of their income on housing. Cities like Miami, Los Angeles and New York had the highest concentrations of house poor residents. Read more in the NYT. |

|

|

5. Versace, Versace, Versace! The luxury retailer Versace is coming to Austin. Specifically they have plans to open a store at the Domain. This store is Versace's first in Austin, although they have a store at the San Marcos outlet. This comes after Hermes opened a store on South Congress. Austin sure is getting bougie isn't it? I bet Gucci is next. Read more in the ABJ. |

|

Featured Listings |

|

Let's check out some eye candy! These are all homes listed for between $2 million and $3 million in Austin. |

|

|