A gradual chill continued in the Manhattan market last month, with inventory rising while macroeconomic factors – rising interest rates, inflation, decline in the stock market, and recession fears – put downward pressure on demand. Anecdotally, the decline in the stock market has been the overwhelming reason for buyers exiting the market. Not only have buyers seen their net worths shrink (making some less qualified for purchases), but the prospect of selling in a bear market has deterred them from liquidating holdings and in some cases, affected expected parental gifts for the same reason. We have not perceived rising interest rates to be nearly as big of a factor as almost all of our buyers have been securing rates from 3.5-4.5% (higher than a year ago but not prohibitive) on their recent loans, and not the 5%+ rates that have made headlines. In May, active inventory saw its first notable uptick (up 4.8% vs. April and 0.4% year-over-year), while signed contracts were down both month-over-month (-9%) and year-over-year (-22.6%). This pushed overall prices down slightly versus last month, although still up year-over-year. Looking closer at these market-wide figures, there was a big difference between coops and condos. Coops saw a 3.9% uptick in inventory yet a substantial -18.5% drop in contracts. On the other hand, both condo inventory and signed contracts were up versus last month (though contracts were down 16.5% from the condo-spree of Spring 2021). |

As we’ve come to expect, the Brooklyn market has been resilient to external factors, with all price metrics (median and average sale prices and average PPSF) again up from April and year-over-year. However, a slight uptick in inventory has curbed the ferocity of bidding wars on some less-special properties. Market-wide, average days on market increased (+7.2% vs. April) and contract activity declined (-9.9% vs. April and -20.6% vs. last May). Nonetheless, rare properties – e.g. 2+ beds with outdoor space in popular neighborhoods or townhomes – are still moving quickly and receiving multiple offers, especially those priced attractively or in especially high-demand / low inventory areas. In contrast to Manhattan, Brooklyn coops outperformed condos last month, with larger increases in price metrics and a smaller decline in both days on market and signed contracts. This can perhaps be attributed to a continued discrepancy in inventory: condo inventory was up 10% vs. April (+2.8% year-over-year) while coop inventory was only up 3% vs. April, and was actually down -8.3% year-over-year. |

In less than 10 years, Compass has become the #1 real estate brokerage in America (RealTrends 500) and one of the youngest companies ever to make the Fortune 500. |

N.Y.C. Companies Are Opening Offices Where Their Workers Live: Brooklyn. |

The frenzied pace of the NYC sales market is calming down, a result of more listings on the market and slowing demand. With less competition, buyers have gained some breathing room—they can take a day or two to make an offer—something not possible in recent months. |

Corporate executives in May bought shares in their companies at a rate not seen since the early days of the Covid-19 pandemic in what some Wall Street analysts said was an encouraging sign for the US stock market. |

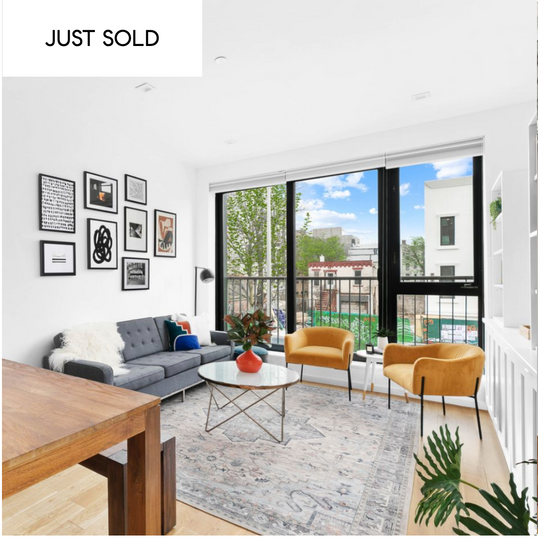

Make sure to take a peek at our current and upcoming listings below. We’ll be back next month with more real estate news. Until next time! |

Below are some important updates on what happened – or rather, did not happen – as the NYS Legislature wrapped its session last week. Thank you to Joshua Kopelowitz, Partner and Co-Chair of the Real Estate Litigation practice of Fox Rothschild, for alerting us to these developments. |

The NYS legislature broke without passing the Good Cause Eviction Bill, which means it won't pass this calendar year, but it remains an important issue for residential landlords to watch. The proposed bill would have essentially barred landlords from ending a tenancy except for certain lease violations and imposed universal rent control by limiting rent increases on all apartments. More details on the bill here. |

The NYS legislature also did not extend, renew, or replace the Affordable New York Housing Program known more commonly as 421-a, which gave developers a multi-year property tax exemption for setting aside 20 percent of their units as rent-stabilized. Note, properties already participating in the 421-a program are not affected, only developments that are not part of the program by the June 15, 2022 deadline. |

While the moratoriums are still expired and most NYC Real Estate attorneys do not think they are coming back, there are still protections for tenants (e.g., New York’s Tenant Safe Harbor Act, Emergency Rental Assistance Program (ERAP), etc.). See more detailed guidance from the AG office here. |

Looking for more? Connect with us for real estate news and market insights. |

|

© Compass 2022 ¦ All Rights Reserved by Compass ¦ Made in NYC

Compass is a licensed real estate broker. All material is intended for informational

purposes only and is compiled from sources deemed reliable but is subject to

errors, omissions, changes in price, condition, sale, or withdrawal without

notice. No statement is made as to the accuracy of any description or measurements

(including square footage). This is not intended to solicit property already listed.

No financial or legal advice provided. Equal Housing Opportunity.

All Coming Soon listings in NYC are simultaneously syndicated to the REBNY RLS.

Photos may be virtually staged or digitally enhanced and may not reflect

actual property conditions.

marketingcenter-newyorkcity-manhattan

|

|

|