|

|

|

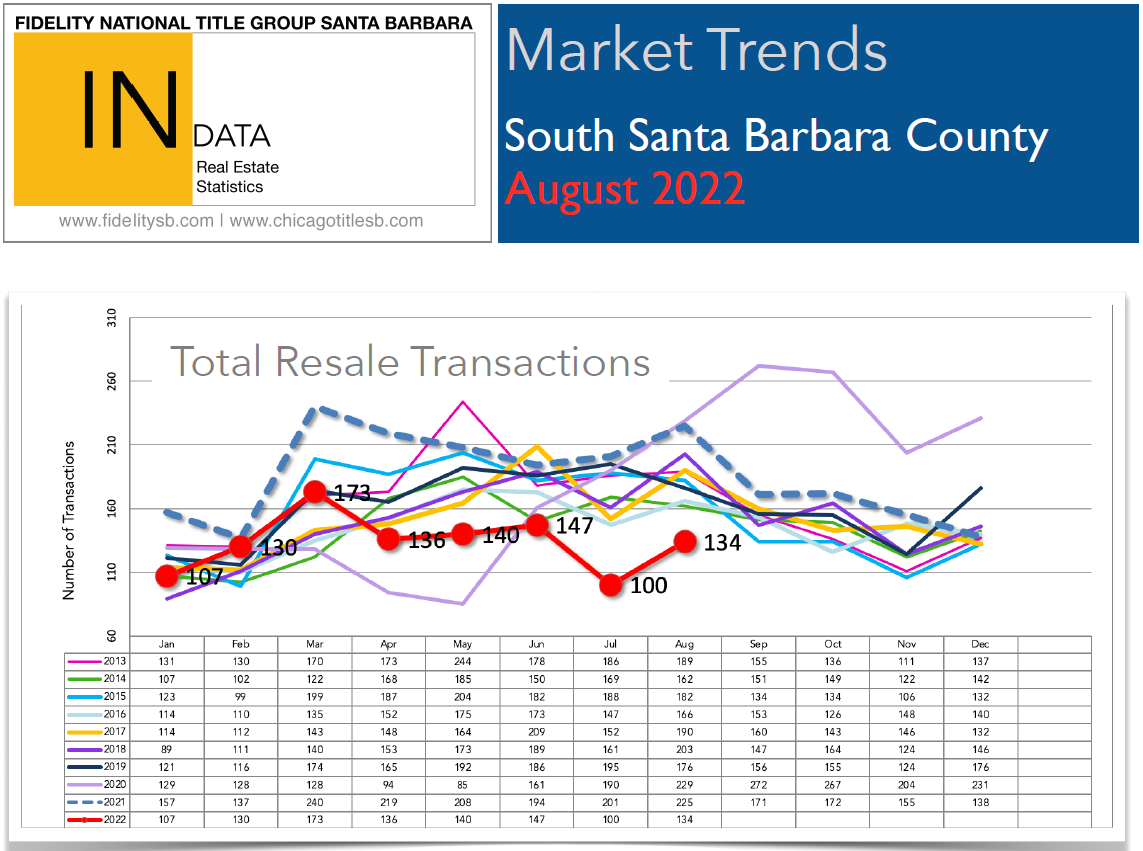

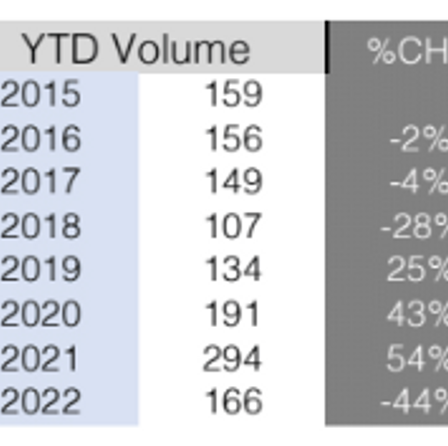

September is here! We have Second Quarter, July, and August numbers now, and the MARKET HAS CHANGED. |

|

Santa Barbara Housing Market UpdateSeptember 2022 |

|

Beginning with the second quarter of 2022 sales are down dramatically from 2021 but also well below pre-pandemic 2019 levels. In mid-June rates shot up over 6%, bounced around for a while, and now have been over 6% for the past week. Housing prices have stopped going up - it's too soon to suggest they are coming down, but properties coming to market over priced are sitting and/or having to adjust price sometimes multiple times to find a buyer. Today's 30 yr. fixed mortgage rate: 6.35% -------------------------------------------------------------- |

|

Second Quarter Sales - a Comparison Total 2Q Sales

2019 was a normal, robust, pre-pandemic year of housing sales. 2020 Spring brought us Covid and lockdowns. 2021 generated unprecedented demand. 2022 is experiencing rapidly rising interest rates coupled with very low inventory. Other than 2020, 2022 proved to be the lowest number of 2Q sales ever recorded. |

|

Monthly Sales Stats 2022 |

|

July 2022 Total Sales Stats vs. 2021 Total Sales: 100 -50% Median Sales Price House: $1,879,500 -1% Median Sales Price Condo: $944,500 +17% Median Days On Market: 10 Cash Sales: 32% Off Market Sales: 17 Inventory Supply: 1.57 months *This is the lowest number of sales ever recorded for July. Historically, July averages 175 sales per month. ___________________________________ |

|

August 2022 Total Sales Stats Total Sales: 133 -41% Median Sales Price House: $2,243,500 +32% Median Sales Price Condo: $1,015.000 +17% Median Days On Market: 11 Cash Sales: 44% Off Market Sales: 23 Inventory Supply: 1.53 months 2021 was the largest number of total annual sales the Santa Barbara market has ever experienced. Will 2022 turn into the lowest? Maybe... |

|

Driving this year's buyer market sentiment:

Dramatic price acceleration over the last two years. Rapid Increase in Interest Rates impacting affordability. Absence of available inventory. Negative Wealth Effect as stock & bond markets sell off Market Volatility Inflation Fear of Recession 2022 sales & inventory are below 2019 levels. ______________________________________ |

|

|

*Error - August had only 133 sales |

|

Montecito |

|

|

Montecito YTD total sales are up from 2019 but dramatically down from 2021. The trend for the second half of the year shows a marked slow-down in total sales. The absence of inventory is having an effect but difficult to believe that's the only affect. There were 4 sales over $5M in July and 7 in August - that is well below last year's pace. *There were 3 sales over $5M in Hope Ranch in July and none in August. |

|

Montecito Sales Volume year over year through August shows a dramatic decrease from last year but remains above pre-pandemic years. Monthly Median Price for July: $3,875,083Annual Median Price for July: $5,225,000 _________________________________ Annual Totals vs. 2022 to date |

|

|

|

----------------------------------------------------------- If the trend continues, we have a market that seems to be slowing, and it appears prices have stopped going up. We are seeing more weekly price adjustments, and days on market for the Active inventory are increasing. Properties priced correctly continue to sell quickly, some with two to three offers. Inventory has doubled from the beginning of the year but continues to be half of what was normal pre-pandemic. If interest rates hold above 6% or continue their upward trajectory, it should continue to dampen activity as rates adversely impact affordability - this should put downward pressure on price. The increased absence of inventory is a newer phenomenon and is perhaps somewhat responsible for current prices remaining elevated. It seems a market correction has begun - only in hindsight will we know exactly what that means. ___________________________________________ |

|

Still Available |

|

|

Sold in June and July |

|

|

If you are thinking of selling... |

|

If you are thinking of selling, be mindful turn-key homes continue to sell more quickly and at higher prices than those needing work and/or updating. COMPASS Concierge is a great tool to use when clean up or updating is needed. Limited to $40K of improvements but at zero cost to you, that $40K could be the difference of fresh paint, staging, and landscape clean up resulting in a quicker sale and $100K increase in the sale price. |

|