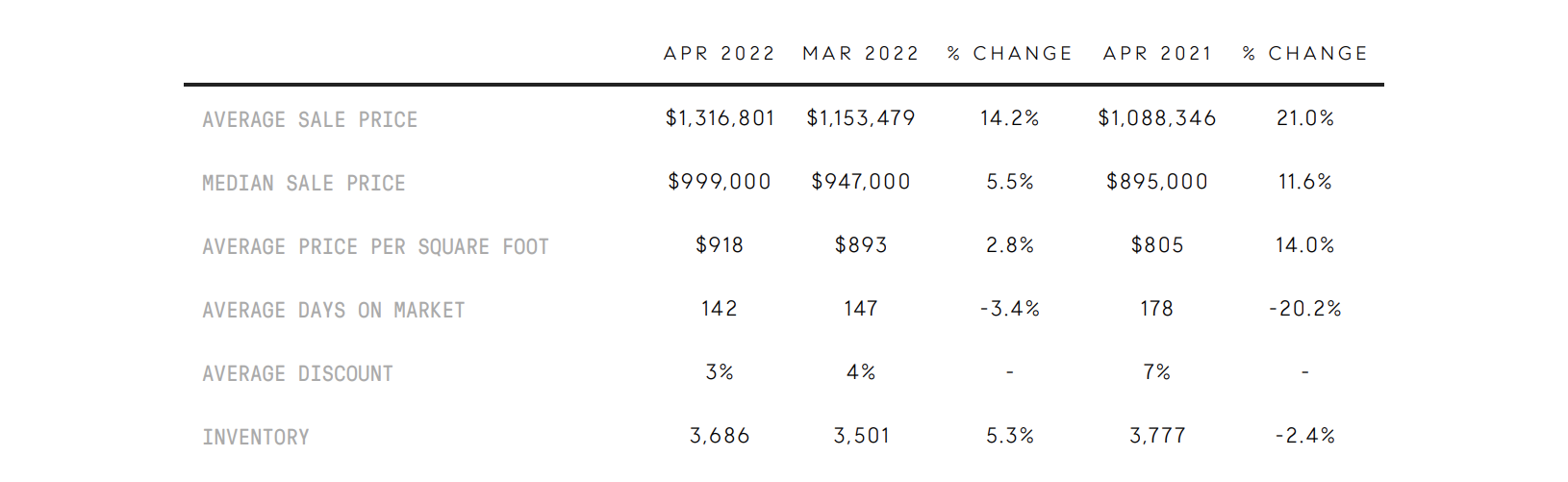

The red-hot market in Manhattan finally showed signs of cooling in April. The number of signed contracts declined month-over-month for the first time since December (-10.7% from March), and inventory levels increased (+5.3% from March). The most obvious reasons for the shift are rising interest rates and an expected seasonal increase in inventory in April (historically, inventory levels are highest April-June). Putting this into perspective, the market is still very strong, but this shift may be the beginning of a trend toward normalization after an unprecedented frenzy in the market. Closed sale data continued on an upward trajectory, but these figures are a lagging indicator reflecting deals that were negotiated and went into contract 2-3 months ago. Closed sale prices were substantially higher than in March (and up double-digit percentages year-over-year) reflecting the surging market during Q1. Properties spent less time on the market and traded at prices that were very close to ask versus last month and last year. |

Since the start of 2022, Downtown Manhattan neighborhoods represented the lion's share of sales and commanded the highest prices, with Nolita, West Village, and SoHo at the top of the list. On the other end of the spectrum, the lowest prices were in Upper Manhattan, followed closely by Midtown East, and then Battery Park City. |

In Brooklyn, rising interest rates seem to have had little effect on the market thus far – prices were up again across all metrics, and days on market and negotiability were down. Inventory did rise slightly, but not as much as total signed contracts. The number of condo contracts declined slightly despite an increase in corresponding inventory, but the data is not so significant as to represent a trend in our view. Overall, Brooklyn buyer demand remains high, and the market seems ready to absorb far more than this small increase in inventory. |

Since the start of 2022, DUMBO, Cobble Hill, and Boerum Hill have commanded the highest prices while homes in East New York / Brownsville, Prospect Lefferts Gardens, and South Brooklyn have sold for the lowest. |

Could renovation costs be coming DOWN in the near future? When interest rates rise, it also becomes more expensive to borrow against a home’s equity to pay for renovations. Less demand for renovation materials and labor could reduce some of the recent runaway prices. (MARKETWATCH) |

With mortgage rates on the rise, Manhattan’s residential market took a breather in April. While o ne month does not make a trend, April might indicate some stabilization of what has been a fiercely competitive Manhattan market . (TRD) |

The City is thriving, but renters who scored a pandemic deal now face rent-renewal sticker shock. Citywide rents rose 33% between January 2021 and January 2022, with some landlords offering renewals at up to double the discounted Covid-era rates. (NYTIMES) |

Interest rates just exceeded 5% for the first time since 2011, but that might not be the reality for many buyers who are taking out larger ("jumbo") loans or are open to adjustable rate and other loan products. |

Looking for more? Connect with us for real estate news and market insights. |

Make sure to take a peek at our current and upcoming listings below. We’ll be back next month with more real estate news. Until next time! |

3 Bed | 3 Bath | $3,150,000 |

1 Bed | 1 Bath | $1,335,000 |

|

2 Bed | 1 Bath | $775,000 |

1 Bed | 1 Bath | $690,000 |

|

|

© Compass 2022 ¦ All Rights Reserved by Compass ¦ Made in NYC

Compass is a licensed real estate broker. All material is intended for informational

purposes only and is compiled from sources deemed reliable but is subject to

errors, omissions, changes in price, condition, sale, or withdrawal without

notice. No statement is made as to the accuracy of any description or measurements

(including square footage). This is not intended to solicit property already listed.

No financial or legal advice provided. Equal Housing Opportunity.

All Coming Soon listings in NYC are simultaneously syndicated to the REBNY RLS.

marketingcenter-newyorkcity-manhattan

|

|

|