|

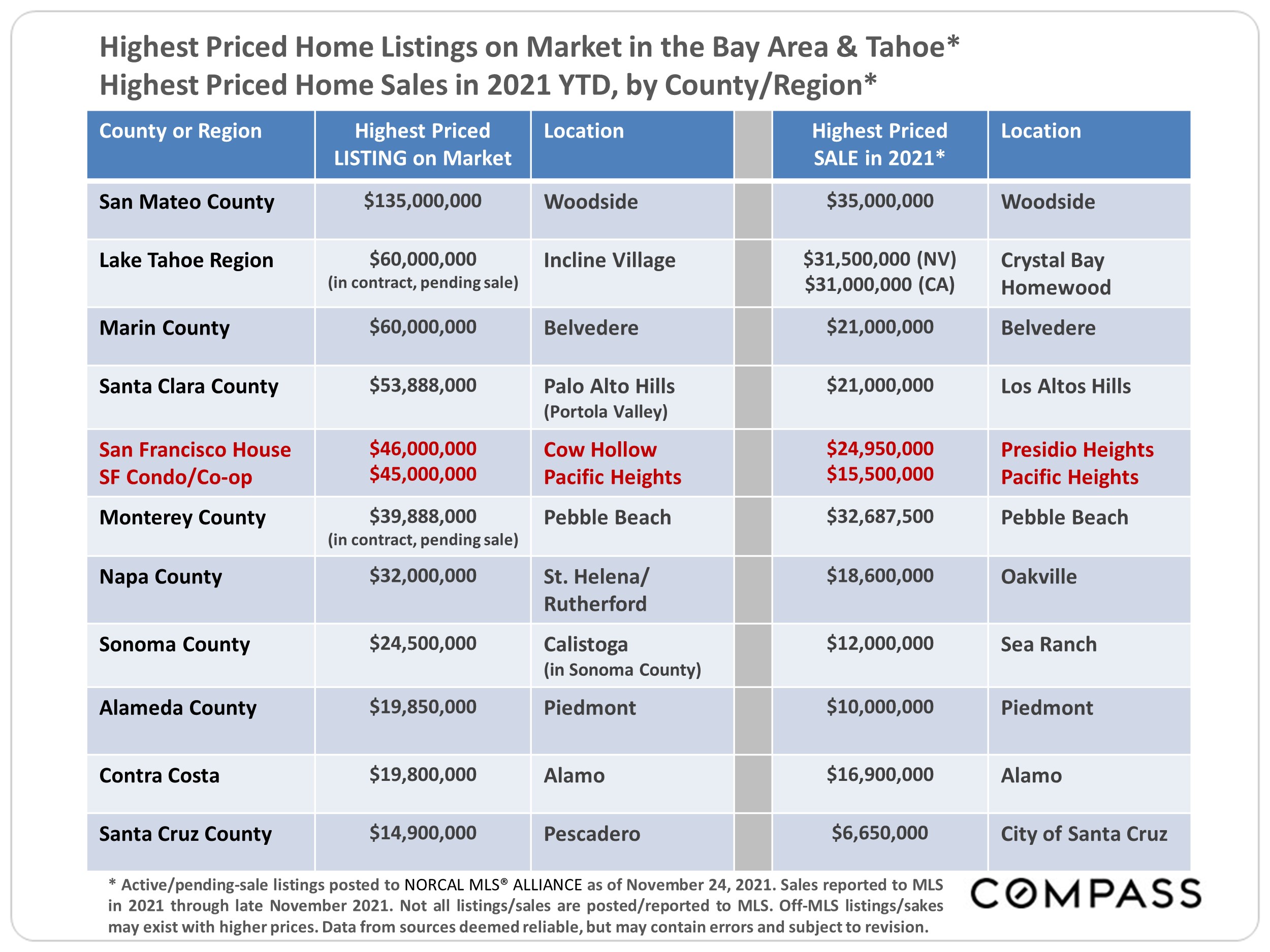

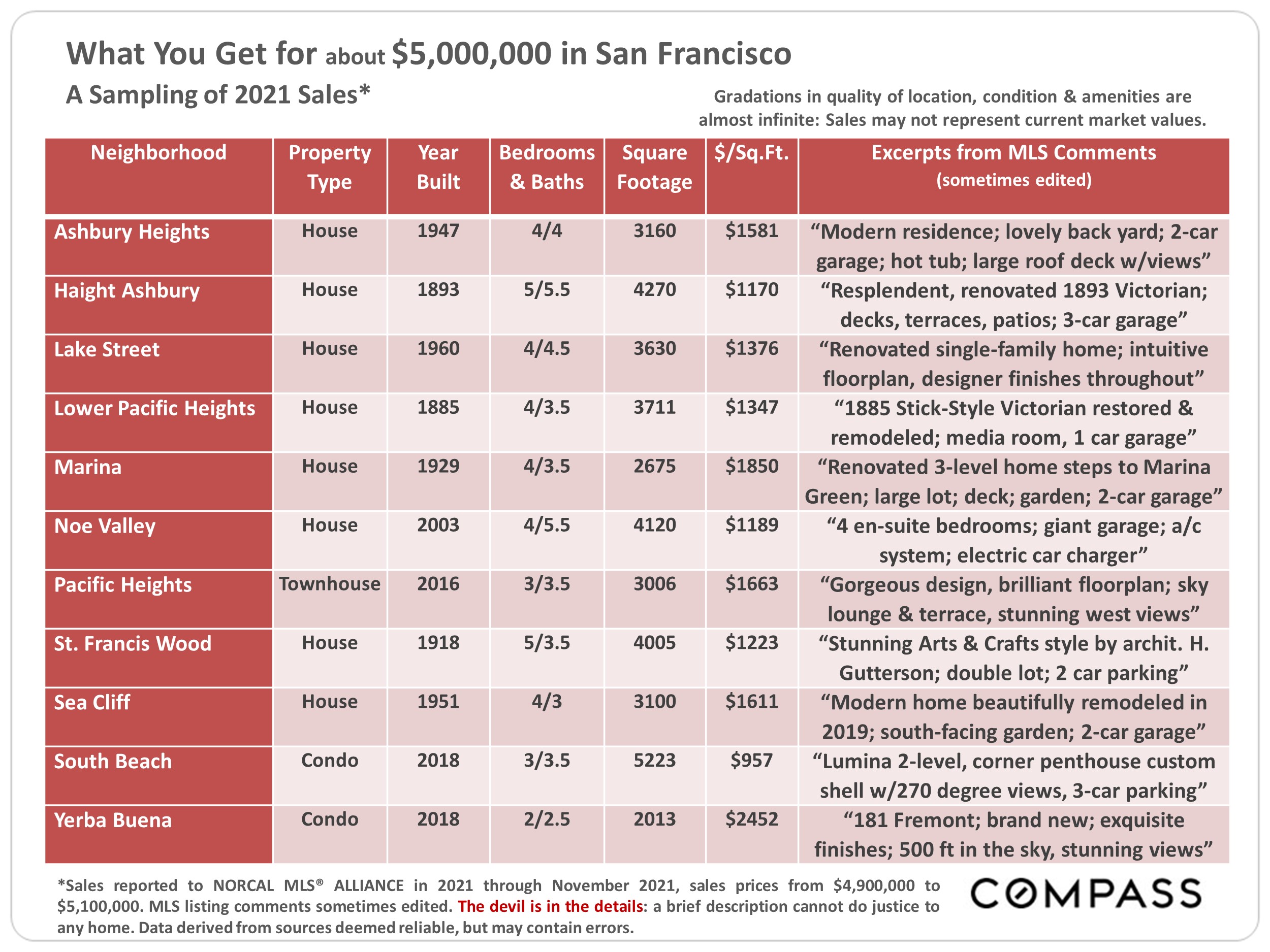

Welcome to the December issue of my SF Real Estate Report. November and December typically see very significant seasonal slowdowns in market activity. However we are slowing down from record breaking activity. In January, I will send a 2021 market review, looking back at what has certainly been one of the highest demand markets in history. I n the meantime, this report will look at the typical info, and also some fun Luxury real estate details.I pulled out some key slides, but the entire report is worth a read! |

|

|

December 2021 SF Market Report |

|

|

|

|

|

|

|

|

|

15 Real Estate Pros Share Their Market Prediction Trends For 2022 And Beyond Real estate is seen as one of the most stable and profitable markets in the U.S. However, the market can shift at any time and it’s important to keep an eye out for upcoming trends. So what can we possibly expect in 2022? |

|

1. Trading Shares 2. Increasing Complexity Of Local Zoning 3. Secondary Market Revitalization 4. More Smart Homes 5. Third-Party Owner Representatives 6. More Property Tech Innovations 7. Virtual Tours Focused On Visuals 8. Digital Currency For Real Estate Transactions 9. Cash-Only Deals |

|

These, of course, are just predictions, but they still can help us be prepared. |

|

Home prices continue to surge, with all nine counties reporting double-digit growth and pushing the median price of an existing single family home to $1.12 million, according to CoreLogic data. Alameda County — up 20% to $1.15 million from the same month last year — led the boom, followed by Napa (up 19% to $825,000) and Solano (up 18% to $555,000) counties. |

|

Millennials Eye the Mobile Home Market Amid Record-High Housing Prices With home prices surging, many buyers, particularly millennial first-timers, are seeking out more affordable housing. And that means taking another look at alternatives like mobile homes. Yes, mobile homes often get a bad rap. But their values have been rising faster than single-family homes, according to a recent report from online financial services marketplace LendingTree. These homes have become even more appealing recently as they support the on-the-go, work-from-home lifestyle during the COVID-19 pandemic. |

|

|

DID YOU KNOW? Nearly $26.7 billion has been invested in climate tech in 2021 through November, up from $15.3 billion in 2020 and $11.8 billion in 2019, according to PitchBook. With homes and buildings specifically, climate change poses a risk to as much as $35 trillion of real estate assets by 2070, according to a 2016 report by the United Nations Framework Convention on Climate Change. One item: Roof sprinkler systems that keep roofs wet and protected during wildfire threats..... (CNBC) DID YOU KNOW? The average 30-year fixed rate dropped just 1 basis point for the week, but saw a wide swing from the beginning of the week to the end of it. Refinance demand surged 9% last week from the previous week. Homebuyer demand for mortgages fell 5% after 4 straight weeks of gains.DID YOU KNOW? Home prices rose 19.5% in September year over year, down from a 19.8% annual gain in August, according to the S&P CoreLogic Case-Shiller national home price index. The 10-city composite rose 17.8% from a year ago, down from an 18.6% gain in August. The 20-city composite gained 19.1% year-over-year, down from 19.6% in the previous month. Cities with the highest price increases were Phoenix, Tampa, and Miami. Chicago, Minneapolis and Washington D.C. saw the smallest annual price gains.....but the gains were all still over 10% well above inflation! (CNBC) |

|

|

|

Let's Get Social |

|

|

|

|

|